[ad_1]

-

Traders need to get technology stocks immediately after their months extended sell-off entered bear current market territory, in accordance to Fundstrat.

-

“Investors deem Technological innovation ‘done’ but we imagine Technologies demand from customers will speed up [over the] following few a long time.”

-

These are the three motives why Fundstrat’s Tom Lee thinks traders really should obtain technologies shares.

Technological innovation shares went from most loved in years of the COVID-19 pandemic to now the most seriously offered, dependent on the fundamental sector efficiency of the inventory sector.

The Nasdaq 100 fell into a bear market place in 2022, dropping about 30% from its file superior, which is a more substantial decline than the index professional in March 2020. A mixture of lofty valuations, a pull ahead in demand, and mounting desire costs assisted gas the months-extensive decline in the sector, among other elements.

But traders must acquire benefit of the decrease and commence shopping for the tech sector, according to a Monday be aware from Fundstrat’s Tom Lee. “Investors deem Engineering ‘done’ but we imagine Know-how demand will speed up [over the] following several yrs,” Lee stated.

Lee made available 3 huge causes why it continue to will make sense to personal the tech sector for the extensive-term, even as more classic economic climate sectors like strength continue on to soar.

1. “Technology desire will speed up as organizations request to offset labor scarcity.”

“World-wide labor supply is shrinking as opposed to demand from customers. Our 2017 evaluation reveals the world is entering a time period of labor lack. Growth fee of employees age 16-64 is trailing full populace development, beginning in 2018. This reverses employee surplus in area considering that 1973,” Lee explained.

The international labor shortage is a prolonged-phrase possibility for engineering and automation to step up and fill the hole, in accordance to Lee.

“2022 is accelerating the use case and ROI for automation. If least wages are climbing, [and] businesses are elevating starting off salaries, this raises the ROI and justification for labor substitution by using automation. This is an obvious demand from customers accelerator for Technological innovation — aka $QQQ Nasdaq 100,” Lee claimed.

2. “Technology valuations are reduce than the 2003 trough.”

The Nasdaq’s rate-to-earnings ratio nowadays is lessen now than it was at the depths of its dot-com unwind, when the Nasdaq 100 declined by almost 80% from its 2000 peak, in accordance to Lee. “Nasdaq 100 is more affordable right now than at the absolute 70-12 months minimal of 2003. Yup, marketplaces crashed worse than dot-com,” Lee explained.

“If everything, this ought to affirm why the danger/reward in FAANG is appealing. Even anecdotally, the negative news appears priced in,” Lee stated.

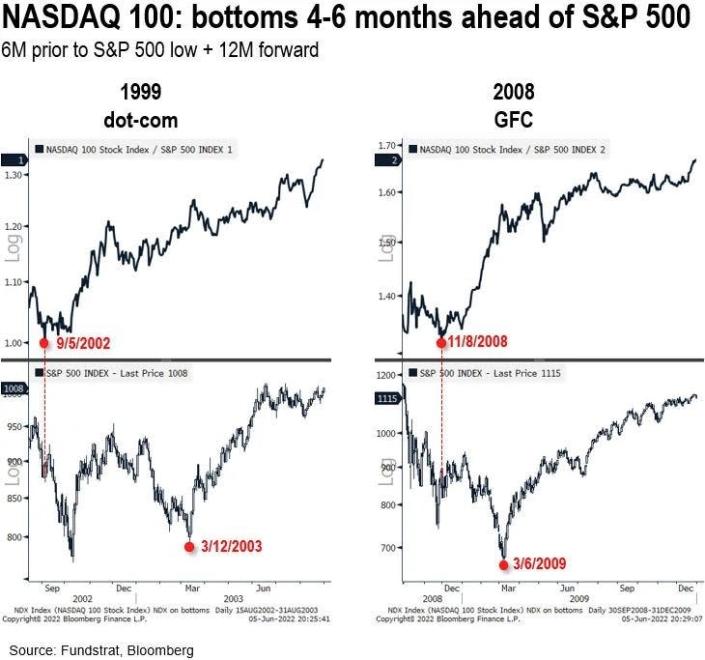

3. “Technological innovation has led off each and every big bottom.”

“What outperformed soon after dot-com crash? Technological know-how stocks… yup. The demand from customers story for Technologies is probable set to speed up in upcoming handful of a long time, and every single big market bottom sees Nasdaq base 4-6 months in advance,” Lee claimed.

Following the the two dot-com bubble burst and the Wonderful Economical Disaster, the Nasdaq outperformed other indices in excess of the subsequent 5 several years, according to Lee. “This chart says it all… we believe FAANG lead publish growth scare,” Lee concluded.

Study the first short article on Organization Insider

[ad_2]

Resource website link