[ad_1]

hh5800/iStock via Getty Images

Microchip

Microchip Technology Incorporated (NASDAQ:MCHP) has a comprehensive product portfolio which includes microcontrollers (PIC, dsPIC, AVR and SAM), FPGAs, microprocessors, digital signal controllers, and more.

We analyzed the company’s business segments, including its microcontroller segment, and identified the main driver of growth as IoT (Internet of Things) and its acquisition of Atmel’s impact on its expanded product portfolio. Moreover, we looked into its FPGA business with its acquisition of Microsemi and its market position against Intel (INTC) and Xilinx in terms of market share. We then analyzed the growth of data volume against the cloud computing market and projected its growth. Lastly, we examined its analog products business segment and its integration with other products to determine whether it has cross-selling abilities and forecasted its revenue growth.

IoT driving Its Microcontroller Segment

Microchip, Khaveen Investments

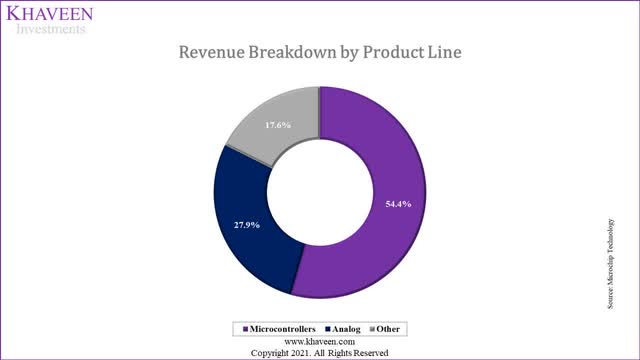

Based on the company’s product segment breakdown from its annual report, Microcontrollers account for the majority (54%) of its revenues. According to Arrow Electronics (ARW), microcontrollers (MCUs) are integrated circuits commonly used and designed for specific applications or tasks. According to All About Circuits, they are optimized for embedded applications. Microcontrollers are commonly available in three distinct types: 8-bit, 16-bit and 32-bit microcontrollers. 8-bit MCUs are the most cost-effective and basic whereas 16-bit and 32-bit MCUs are normally used in more complex embedded applications, offering enhanced performance and functionality.

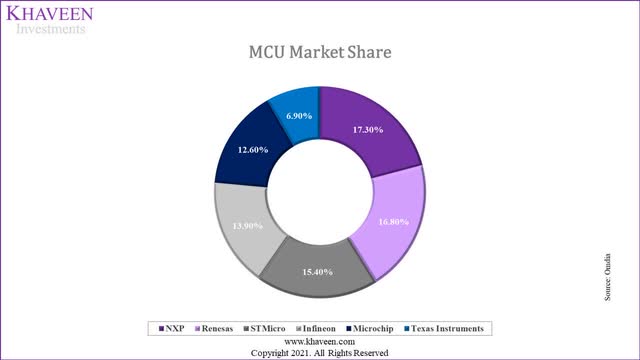

According to IC Insights, the MCU market is forecasted to grow at a CAGR of 6.7% through 2026. In terms of market share, the MCU market is dominated by NXP (NXPI) (17.3%) and Renesas (OTCPK:RNECF) (16.8%). However, Microchip had been one of the quickest-growing 16-bit & 32-bit microcontroller providers globally, earning themselves the 5th spot with a 12.6% market share.

Omdia

IoT

Khaveen Investments

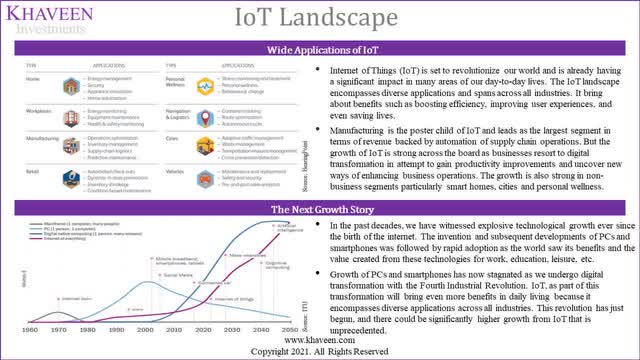

Driven by the rise of IoT, the demand for MCUs is expected to increase with the growing web of connected electronic devices, according to Grand View Research. In manufacturing, automation of supply chains is an area which could support the growth of IoT. Moreover, the automotive industry is also one of the largest customers of microcontrollers due to the increased emphasis on safety, comfort and fuel-efficient vehicles. The industry uses 16-bit and 32-bit microcontrollers extensively, while the cost-efficient and high-speed 32-bit segment is expected to be the fastest-growing moving forward.

The ongoing advancements in automotive technologies could spur higher growth of MCU content per vehicle with additional features including reversing assistant, blind-spot information systems and night vision assistance. Moving forward with the Fourth Industrial Revolution, IoT as a part of the transformation is expected to experience a higher unprecedented growth where its application could be widely adopted across various industries.

Microchip

Throughout the years, Microchip had made several acqu

isitions to expand its Microcontroller product portfolio. In 2016, it acquired its microcontroller competitor, Atmel for $3.56 bln. According to Microchip, Atmel’s AVR 8-bit and 32-bit microcontrollers strongly complement its existing PIC (Programmable Interface Controllers) microcontrollers due to their different strengths and focus.

PIC microcontroller is known for its ease of programming and interfering with other peripherals. PIC microcontrollers are commonly found in electronic devices like phones, computer control systems and embedded systems as they are the world’s smallest microcontrollers that can be programmed to complete a broad range of tasks. AVR microcontrollers are categorized into three types according to their memory and application: TinyAVR, MegaaAVR, and XmegaAVR microcontrollers are about 4 times faster than PIC microcontrollers and are more power conserving.

Moreover, Microchip had released a high-precision voltage reference (Vref) IC specifically for automotive and industrial applications. The new MCP1502 claims to be an update of the current, with lower cost, higher reliability and performance, as well as a smaller size.

Overall, we expect the company to capitalize on the rising trend of IoT with its MCU products and projected its MCU revenue to grow at the market forecast growth rate of 10% by IC Insights in FY2023 followed by the market forecast CAGR of 6.7% but tapered down by 1% per year as a conservative estimate.

|

Microchip Microcontroller Revenue ($ mln) |

2020 |

2021 |

2022 |

2023F |

2024F |

2025F |

2026F |

2027F |

|

MCU Revenue |

2,818 |

2,961 |

3,815 |

4,196 |

4,435 |

4,644 |

4,816 |

4,946 |

|

Growth |

-3.56% |

5.08% |

28.83% |

10.00% |

5.70% |

4.70% |

3.70% |

2.70% |

Source: Microchip, IC Insights, Khaveen Investments

Opportunity in the Niche FPGA market

Company Data, Markets and Markets, Khaveen Investments

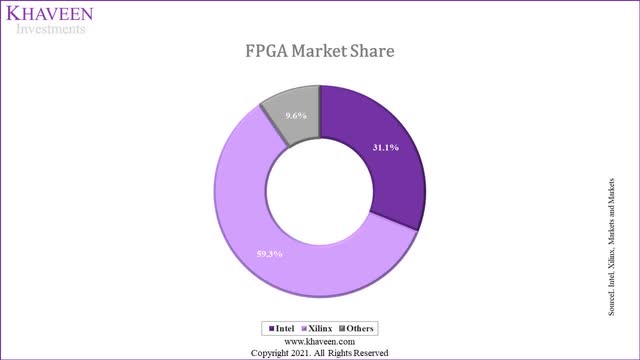

According to Markets and Markets, the FPGA market is expected to reach a market size of $ 9.1 bln by 2026, growing at a 7.8% CAGR. The market is mainly dominated by Intel and Xilinx. The duopoly accounts for more than 9% of the market share. Nonetheless, Microchip secured third place in the FPGA market and has a higher average 3-year revenue growth rate than Intel, the market leader.

|

Company |

3-year Average Revenue Growth |

|

Intel |

-2.9% |

|

Xilinx |

8.7% |

|

Microchip |

6.0% |

Source: Intel, Xilinx, Microchip, Khaveen Investments

Data Volume

According to Markets and Markets, FPGAs are used in data centers to offload computing workloads from server CPUs and accelerate specific services. Due to the advent of technologies and applications such as “AI, IoT, Big Data, streaming analytics, network security and genomics,” the volume of data that needs processing in data centers is increasing explosively according to Bill Mannel, Vice President & General Manager of High-Performance Computing & Artificial Intelligence at Hewlett Packard Enterprise.

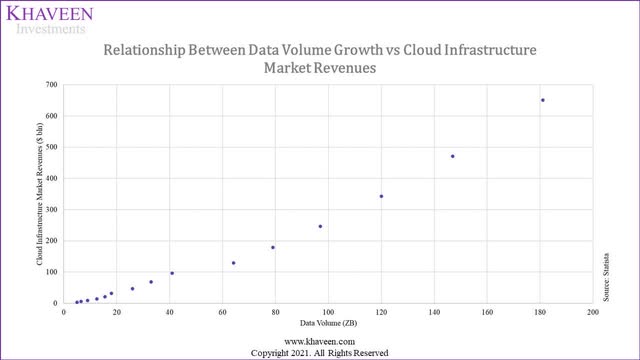

Moreover, the IDC forecasted data volumes to grow at a CAGR of 23% through 2025. In our previous analysis of Nvidia, we analyzed and determined the factor of correlation between cloud infrastructure revenue and data volume. Based on that, we updated our projections with 2021 figures with a correlation factor of 1.73x which we applied to the forecasted data volume and obtained a 5-year forward average growth of 39.8% for the cloud infrastructure market.

Statista, IDC, Khaveen Investments

|

Cloud Infrastructure Market Projections |

2017 |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Cloud Infrastructure Market Revenues ($ bln) |

46.5 |

69 |

96 |

129.5 |

178 |

248.1 |

349.7 |

485.7 |

679.8 |

950.3 |

|

Cloud Infrastructure Market Revenue Growth % (‘a’) |

45.3% |

48.4% |

39.1% |

34.9% |

37.5% |

39.4% |

41.0% |

38.9% |

40.0% |

39.8% |

|

Data Volume (ZB) |

26 |

33 |

41 |

64.2 |

79 |

97 |

120 |

147 |

181 |

182 |

|

Data Volume Growth % (‘b’) |

44.4% |

26.9% |

24.2% |

56.6% |

23.1% |

22.8% |

23.7% |

22.5% |

23.1% |

23.0% |

|

Cloud Infrastructure Revenue Growth/Data Volume Growth (‘c’) |

1.02 |

1.80 |

1.61 |

0.62 |

1.62 |

1.73 |

1.73 |

1.73 |

1.73 |

1.73 |

*a = b x c

Source: Statista, IDC, Khaveen Investments

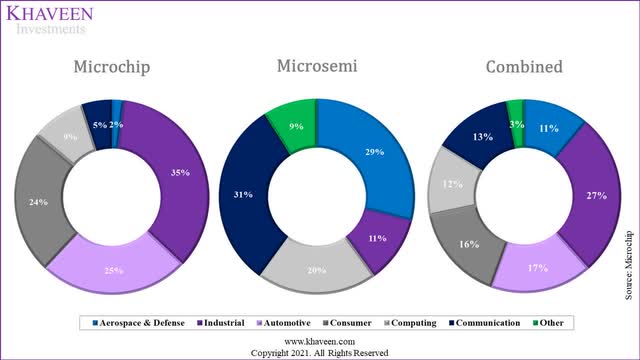

Microchip

In 2018, Microchip solidified its FPGA product line with the acquisition of Microsemi for $10.15 bln, which enabled it to expand its offerings and strengthen its market position in data centers, communication and aerospace & defense markets.

Microchip

According to Microchip, its FPGAs and SoC FPGAs are 30%-50% more power-efficient than competitors’ FPGAs, with the adoption of non-volatile technology to minimize leakage between configuration cells. Microchip FPGAs are built using a single transistor, which reduces leakage current compared to competitor FPGAs which use six transistors. In 2021, the company announced that its PolarFire FPGAs passed both the military temperature grade (-40°C to 125°C TJ) and Automotive Electronics Council Q100 (AEC-Q100) specification Grade T2 (-40°C to 125°C TJ) and started to accept orders in volume production quantities.

Although a new player in the market, we believe Microchip could be able to effectively compete in the FPGA market, considering the following industry dynamics:

- The FPGA market is dominated by just three players including Intel (Altera), Xilinx (AMD), and Microchip.

- FPGA uses advanced technology and requires a high degree of product reliability, which Microchip has already achieved technological leaps in.

- The main customers for the FPGA market are data centers and cloud infrastructure providers, which are experiencing high demand in line with rising data volume creation.

Hence, at the very minimum, we believe Microchip would be able to grow its FPGA revenues at the market CAGR of 7.8% but tapered down by 1% per year as a conservative estimate.

|

Microchip FPGA Revenue ($ mln) |

2020 |

2021 |

2022 |

2023F |

2024F |

2025F |

|

FPGA Revenue |

945 |

958 |

1,067 |

1,150 |

1,228 |

1,300 |

|

Growth |

5.39% |

1.31% |

11.42% |

7.80% |

6.80% |

5.80% |

Source: Microchip, Markets and Markets, Khaveen Investments

Cross-Selling Opportunities for Analog Products

Market

ICInsights, WSTS, Company Data, Khaveen Investments

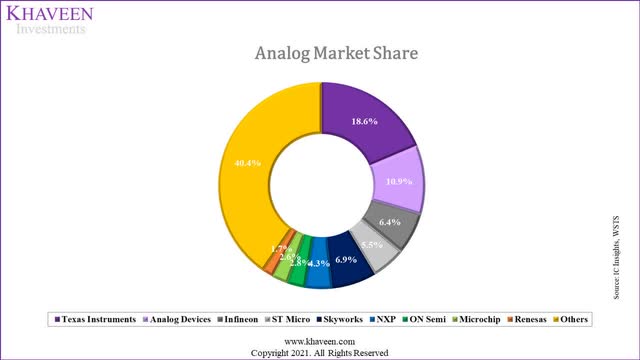

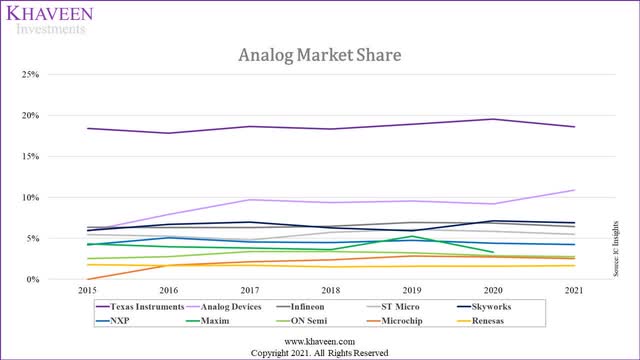

The global analog integrated circuits market is forecasted to grow at a 5.5% CAGR through 2027 according to Modor Intelligence. Based on data from IC Insights, Texas Instruments (TXN) dominated the market with an 18.6% market share, followed by Analog Devices (ADI) with a 10.9% market share. Microchip is ranked in ninth place with a 2.6% market share.

Microchip markets and cross-sells its analog, power, interface, mixed-signal, and timing products with its microcontrollers, microprocessors and memory products. This is because Microchip designs its analog products to integrate seamlessly with its product portfolio of microcontrollers, digital signal controllers, microprocessors, and FPGAs.

Microchip

Based on its annual report, Microchip’s analog product line includes

power management, linear, mixed-signal, high voltage, thermal management, discrete diodes and MOSFETS, RF, drivers, safety, security, timing, USB, ethernet, wireless and other interface products.

In 2019, the company also started volume production of a family of silicon carbide ((SiC)) products, for electric vehicles and other high-power applications in the fast-growing markets such as industrial, aerospace and defence markets. Responding to the rising demand for accurate time-keeping devices and MEMS-based oscillators, Microchip acquired Tekron, a New Zealand-based company to establish its presence within the synchronization and timing market for applications in government, military, enterprise and communications. Tekron was a global leader in offering high precision GPS and atomic clock time-keeping technologies and solutions for the smart grid and other industrial and smart energy applications. The result of the acquisition was a portfolio boost including products like oscillators, atomic clocks, network synchronization portfolio for Synchronous Ethernet (SyncE) and more.

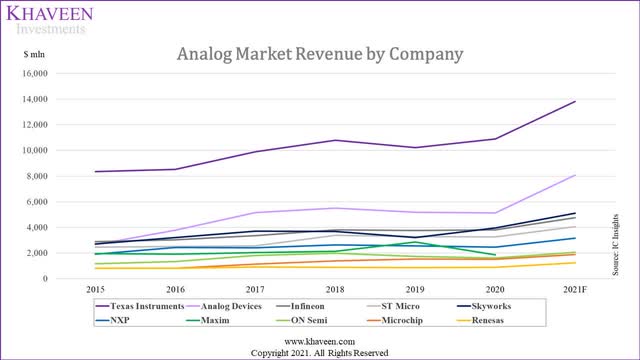

Its 6-year CAGR of 18.3% massively outperformed the average analog market growth rate of 8.6%. The only other player that has higher growth than Microchip is Analog Devices with a CAGR of 20.3%.

|

Analog Market Revenues ($ mln) |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR |

|

Texas Instruments (TXN) |

8,340 |

8,536 |

9,900 |

10,801 |

10,223 |

10,886 |

13,809 |

8.8% |

|

Analog Devices (ADI) |

2,665 |

3,790 |

5,159 |

5,505 |

5,169 |

5,132 |

8,072 |

20.3% |

|

Infineon (OTCQX:IFNNY, OTCQX:IFNNF) |

2,885 |

3,030 |

3,355 |

3,810 |

3,755 |

3,820 |

4,769 |

8.7% |

|

ST Micro (STM) |

2,465 |

2,519 |

2,551 |

3,373 |

3,283 |

3,259 |

4,070 |

8.7% |

|

Skyworks (SWKS) |

2,700 |

3,205 |

3,710 |

3,686 |

3,205 |

3,970 |

5,110 |

11.2% |

|

NXP |

1,905 |

2,430 |

2,415 |

2,645 |

2,564 |

2,466 |

3,168 |

8.8% |

|

ON Semi (ON) |

1,155 |

1,335 |

1,800 |

1,990 |

1,740 |

1,606 |

2,060 |

10.1% |

|

Microchip |

819 |

1,140 |

1,389 |

1,531 |

1,511 |

1,895 |

18.3% |

|

|

Renesas |

805 |

810 |

915 |

900 |

860 |

890 |

1,237 |

7.4% |

|

Total |

45,230 |

47,850 |

53,070 |

58,790 |

53,940 |

55,660 |

74,110 |

8.6% |

Source: WSTS, ICInsights, Company Data, Khaveen Investments

WSTS, ICInsights, Company Data, Khaveen Investments

As seen below, Microchip’s high growth has enabled them to steadily grow its market share over the past 6 years. It has increased its market share by 2.6%. Only Analog devices have gained more market share in this period. Considering Microchip has only entered the analog market in 2016 with the acquisition of Atmel, this speaks to their ability to cross-sell their analog products to their Microcontroller & FPGA segments.

|

Market Share |

2015 (‘a’) |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 (‘b’) |

Change in Market Share (‘c’) |

|

Texas Instruments |

18.4% |

17.8% |

18.7% |

18.4% |

19.0% |

19.6% |

18.6% |

0.2% |

|

Analog Devices |

5.9% |

7.9% |

9.7% |

9.4% |

9.6% |

9.2% |

10.9% |

5.0% |

|

Infineon |

6.4% |

6.3% |

6.3% |

6.5% |

7.0% |

6.9% |

6.4% |

0.1% |

|

ST Micro |

5.4% |

5.3% |

4.8% |

5.7% |

6.1% |

5.9% |

5.5% |

0.0% |

|

Skyworks |

6.0% |

6.7% |

7.0% |

6.3% |

5.9% |

7.1% |

6.9% |

0.9% |

|

NXP |

4.2% |

5.1% |

4.6% |

4.5% |

4.8% |

4.4% |

4.3% |

0.1% |

|

Maxim |

4.3% |

4.0% |

3.8% |

3.6% |

5.3% |

3.3% |

0.0% |

-4.3% |

|

ON Semi |

2.6% |

2.8% |

3.4% |

3.4% |

3.2% |

2.9% |

2.8% |

0.2% |

|

Microchip |

0.0% |

1.7% |

2.1% |

2.4% |

2.8% |

2.7% |

2.6% |

2.6% |

|

Renesas |

1.8% |

1.7% |

1.7% |

1.5% |

1.6% |

1.6% |

1.7% |

-0.1% |

|

Others |

45.0% |

40.7% |

37.9% |

38.4% |

34.8% |

36.4% |

40.4% |

-4.6% |

*c = b – a

Source: ICInsights, Khaveen Investments

WSTS, ICInsights, Company Data, Khaveen Investments

The Analog market is forecasted to grow at 5.5% by Modor Intelligence. However, we believe Microchip’s analog segment could continue growing above the market average growth. Correspondingly, we have used its 5-year average CAGR in 2023 before tapering it down to the market average growth rate.

|

Microchip Analog Revenue ($ mln) |

2020 |

2021 |

2022 |

2023F |

2025F |

2026F |

2027F |

|

|

Analog Revenue |

1,511 |

1,520 |

1,939 |

2,293 |

2,639 |

2,953 |

3,210 |

3,386 |

|

Growth |

-1.28% |

0.58% |

27.59% |

18.27% |

15.08% |

11.89% |

8.69% |

5.50% |

Source: Khaveen Investments

Risk: High Leverage

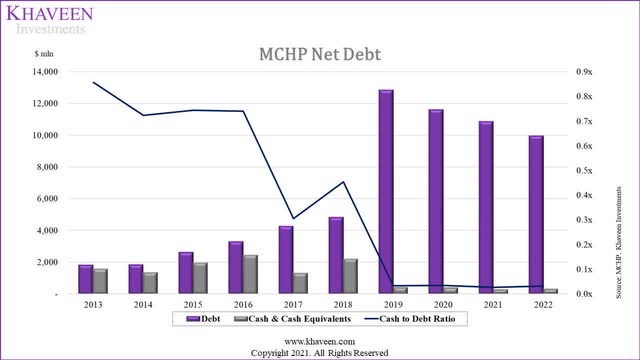

Microchips have incurred an additional debt of $8 bln to fund the $10.15 bln acquisition of Microsemi in 2018, which added substantially to their debt obligation. Its cash to debt ratio decreased to 0.03x in FY2019 from 0.45x in the prior year and remained at 0.03x in FY2022. Moreover, it has a net debt of a % of the market cap of 29%. Notwithstanding, its FCF interest coverage ratio was still positive at 9x in 2022 compared to its 10-year average of 0.9x which indicates its ability to service its debts. Also, Microchip has displayed its strong ability to generate free cash flow, with a positive free cash flow margin of 29.8% in the past 3 years. Thus, we believe that Microchip possesses the ability to pay back its debt due to its free cash flow generated.

Microchip, Khaveen Investments

Valuation

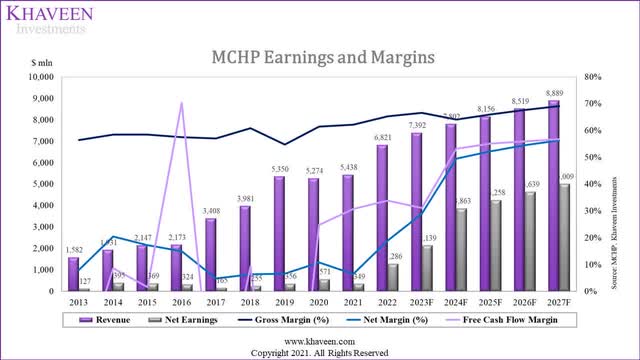

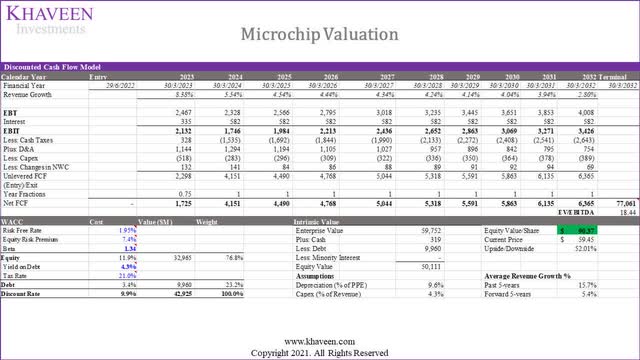

Microchip has achieved a 5-year average revenue growth rate of 15.66% and 60.9% gross margins and 9.8% net margins. Over the past ten years, the company’s COGS has shown a decreasing trend, declining at an average of 3.6%, strengthening the company’s earnings and margins.

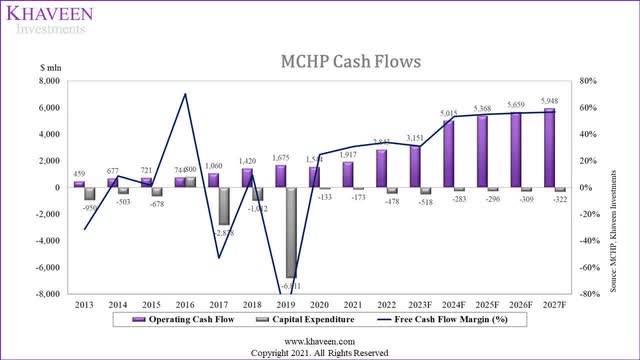

Microchip, Khaveen Investments

In terms of cash flows, the company has experienced a dip in 2017 and 2019, both resulting from its acquisitions, mainly referring to the Atmel acquisition and Microsemi acquisition. Nonetheless, the company has portrayed its strength in generating free cash flows with an average FCF margin of 33.88% in FY2022.

Microchip, Khaveen Investments

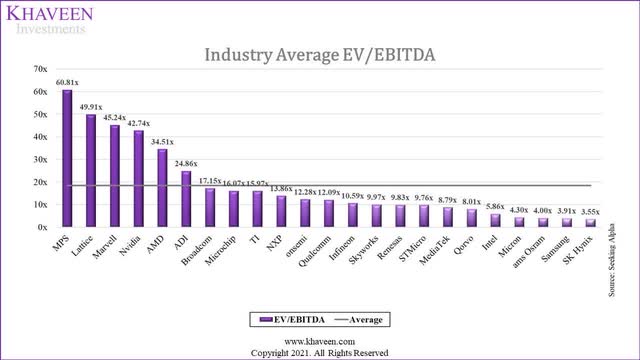

To value the company, a DCF valuation approach was adopted as Microchip is expected to continue generating strong positive free cash flows in future. We compared the company with its comparable peers in the industry with an EV/EBITDA average of 18.44x.

SeekingAlpha, Khaveen Investments

We summarized our projection of the company’s revenues based on its product groups including microcontrollers, analog and FPGAs in the table below.

|

Microchip Revenue Projections ($ mln) |

2021 |

2022 |

2023F |

2024F |

2025F |

|

Microcontrollers |

2,961 |

3,815 |

4,196 |

4,435 |

4,644 |

|

Growth (%) |

28.8% |

10.0% |

5.7% |

4.7% |

|

|

Analog |

1,520 |

1,939 |

2,046 |

2,138 |

2,213 |

|

Growth (%) |

27.6% |

5.5% |

4.5% |

3.5% |

|

|

Other |

958 |

1,067 |

1,150 |

1,228 |

1,300 |

|

Growth (%) |

11.4% |

7.8% |

6.8% |

5.8% |

|

|

Total Revenue |

5,438 |

6,821 |

7,392 |

7,802 |

8,156 |

|

Total Growth |

25.42% |

8.38% |

5.54% |

4.54% |

Source: Microchip, Khaveen Investments

Based on a discount rate of 9.9%, (company’s WACC), our model shows its shares are undervalued by 52%.

Khaveen Investments

Verdict

All in all, we believe its microcontroller segment, which is its largest segment (54.4% of revenue), to grow with the increasing adoption of IoT and supported by its acquisition of Atmel in 2016 as the company expanded its product portfolio, with Atmel’s AVR microcontrollers complementing its current PIC microcontrollers with their different strengths. We projected its microcontroller segment revenue to grow by a forward 5-year average of 5.4%. Furthermore, we believe its FPGA business which has expanded through its acquisition of Microsemi could benefit from the expected rise in data volumes spurring the growth of data centers and projected its revenue to grow by 5.8% on average through 2027. Finally, we analyzed its analog business (27.9% of revenue) and believe it could benefit by cross-selling its analog products to its customers from different segments with the integration with its other microcontrollers, microprocessors, FPGAs, and digital signal controller products.

We forecasted its analog revenue to grow modestly at a 5-year forward growth rate of 3.5%. Overall, we expect its revenue to grow at a 5-year average of 5.4% in total and rate the company as a Strong Buy with a price target of $90.37.

[ad_2]

Source link